Self Managed Superannuation Strategy

‘Superannuation; an arrangement people make to have funds available for them in retirement.’

Superannuation sounds like a fairly simple concept: Make contributions to your Fund whilst you are working, and commence withdrawing on those funds upon retirement. For some people, superannuation is simply a statement that arrives in their letter box every year.

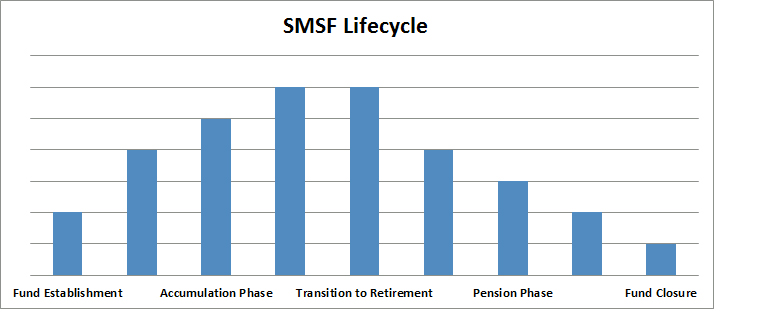

Once you scratch the surface however you will find it is a highly complex, regulated and specialised area. Even more so for those who operate s Self Managed Super Fund. Below are the stages of what you might term the SMSF Lifecycle. At each stage there are various strategies that can or need to be implemented to get the most out of your super.

Whilst the complexities associated with Self Managed Superannuation can appear daunting, managed properly an SMSF should be the key foundation to your retirement lifestyle.

Many clients have a simple reason for wanting to establish an SMSF; they want more control over their money and how it is invested.

But one of the reasons many don’t end up establishing an SMSF is the fear of added compliance and paperwork that comes with managing your own superannuation.

Why not have the best of both worlds by using our administration service. We can help you cut through the clutter, regardless of stage of the SMSF Lifecycle you find yourself in. We can identify and implement the most appropriate strategies for you, and help manage, grow and maintain visibility on your most important retirement asset.

Start Planning Your Financial Future and make an appointment with us today.